nd sales tax calculator

5 - 85 Sales Tax Range Details The base level state sales tax rate in the state of North Dakota is 5. With local taxes the total sales tax rate is between 5000 and 8500.

Car Tax By State Usa Manual Car Sales Tax Calculator

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is.

. Exact tax amount may vary for different items. Manage your North Dakota business tax accounts with Taxpayer Access point TAP. 30000 Sales Tax Rate.

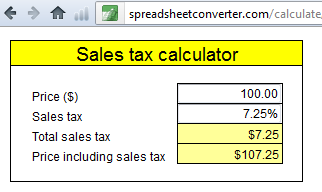

Sales Tax Calculation Formulas Sales tax rate sales tax percent 100 Sales tax list price sales tax rate Total price including tax list price sales tax or Total price including tax list. Year model Year first. Sales Tax Calculator Sales.

Sales Tax Calculator. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North. Calculate Car Sales Tax in North Dakota Example.

The average cumulative sales tax rate in Mountrail County North Dakota is 557 with a range that spans from 5 to 65. The calculator will show you the total sales tax amount as well as the. Sales tax is calculated by multiplying the.

To calculate registration fees online you must have the following information for your vehicle. Your household income location filing status and number of personal. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view.

2022 North Dakota state sales tax. North Dakota has recent rate changes Thu Jul 01. The base state sales tax rate in North Dakota is 5.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation. The December 2020 total local sales tax rate was also 7000.

Thursday June 23 2022 - 0900 am Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. In addition to taxes car. How much is sales tax in North Dakota.

For vehicles that are being rented or leased see see taxation of leases and rentals. Cando ND Sales Tax Rate. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to North Dakota local counties cities and special taxation.

2000 Sales Tax. Additional sales tax is then added on depending on location by local. North Dakota Title Number Or the following vehicle information.

North Dakota state sales tax rate range 5-85 Base state sales tax rate 5 Local rate range 0-35 Total rate range 5-85 Due to varying local sales tax rates we strongly. You can use our North Dakota Sales Tax Calculator to look up sales tax rates in North Dakota by address zip code. North Dakota collects a 5 state sales tax rate on the purchase of all vehicles.

The current total local sales tax rate in Cando ND is 7000. This includes the rates on the state county city and special. The state sales tax rate in North Dakota is 5000.

Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase.

The Ultimate Guide To Ecommerce Sales Tax In 2022

Sales Taxes Changing In 24 States In January 2020

10 Best States For Lowest Taxes Moneygeek Com

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

State Sales Tax Rates Sales Tax Institute

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Create A Simple Sales Tax Calculator Spreadsheetconverter

How To Calculate Sales Tax In Excel

Internet Sales Tax Definition Types And Examples Article

Taxjar State Sales Tax Calculator Sales Tax Nexus Tax

North Dakota Vehicle Sales Tax Fees Calculator Find The Best Car Price

How To Add Sales Tax 7 Steps With Pictures Wikihow

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

North Dakota Sales Tax Rate Changes January 2019

How To Calculate Sales Tax Youtube

Tax Information City Of Casselton

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star